Your Payroll Service does an excellent job of executing the fundamentals of paying your employees, filing your quarterly reports, and paying your employment taxes.

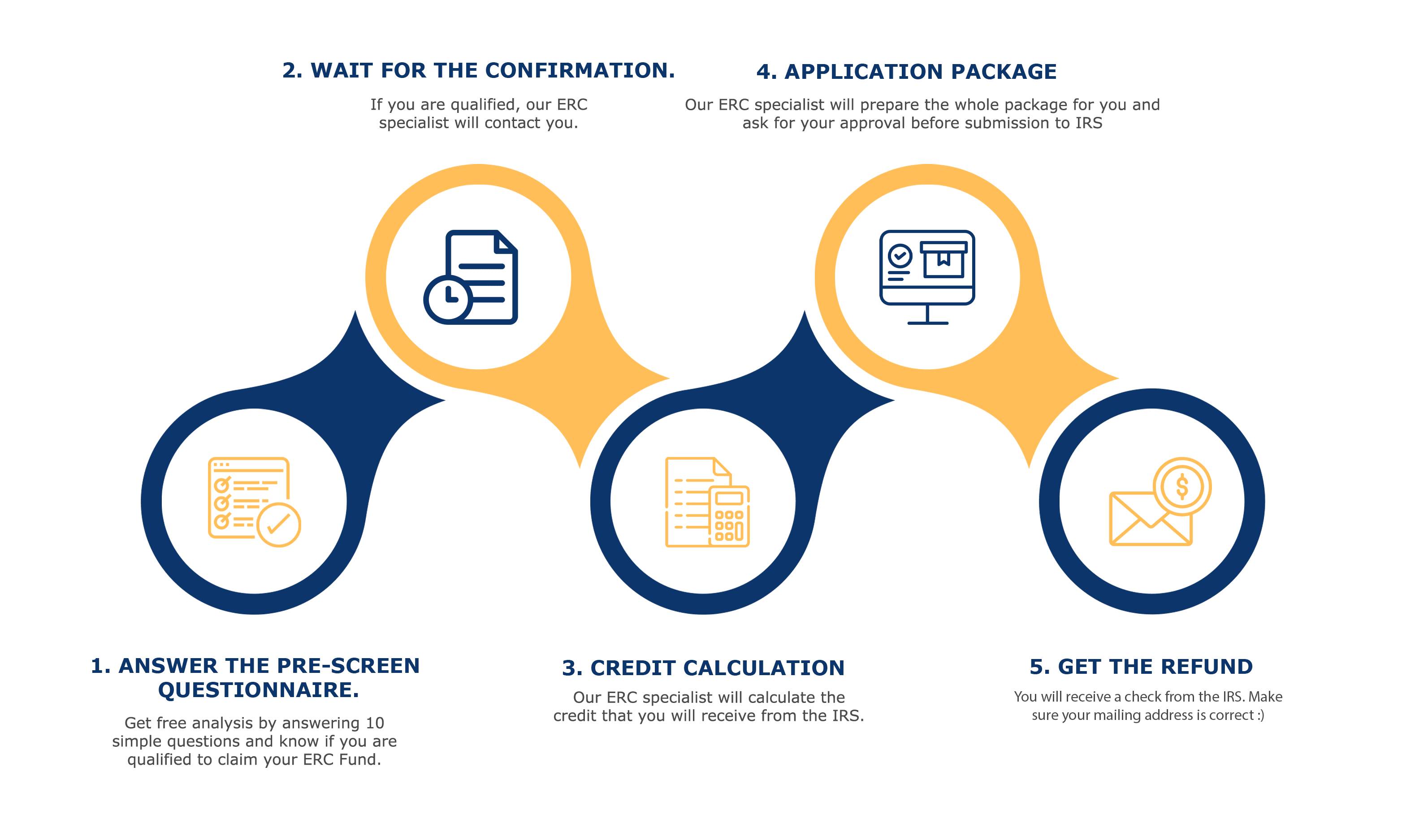

However, calculating your ERC credits necessitates access to your P&L and PPP forgiveness applications. Not to mention the complicated requirements for eligibility and allocating ERC credits at the employee level while accounting for annual and quarterly qualifying wage gaps. . .

You can probably guess why Payroll Services do not offer to handle all of this for you.

So far, the Payroll Services that we've worked with have been happy to provide the payroll registers that we require to perform the allocations. They are also willing to file the Amended Form 941-X with the IRS on our client's behalf.

But that's all there is to it.

In fact, most wise Payroll Services require clients to sign an indemnification waiver before submitting a Form 941-X, as the Payroll Service cannot be held liable for the accuracy of the ERC credits you are claiming.

It is a liability and beyond their scope of services for them to become involved in the complexities of this calculation.